Calculate the Following Financial Ratios for Phone Corporation

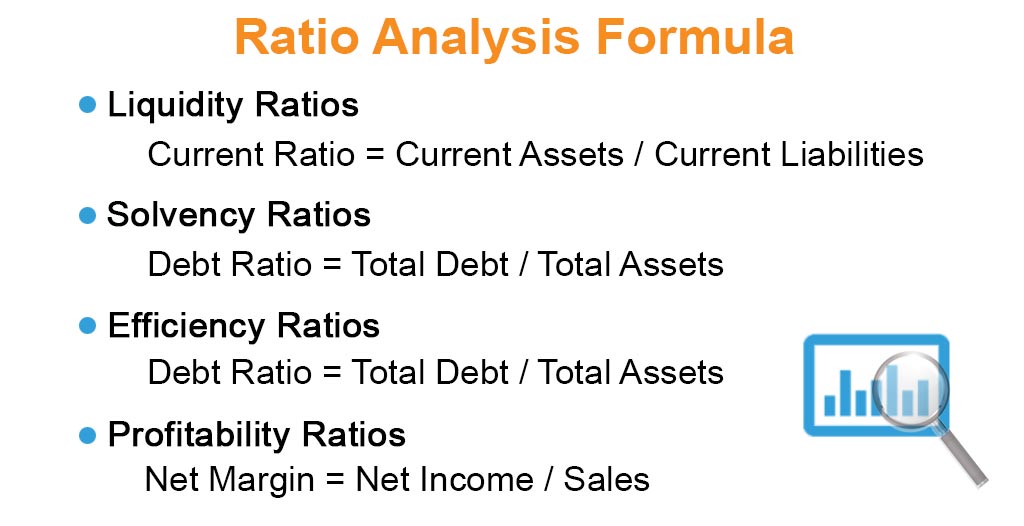

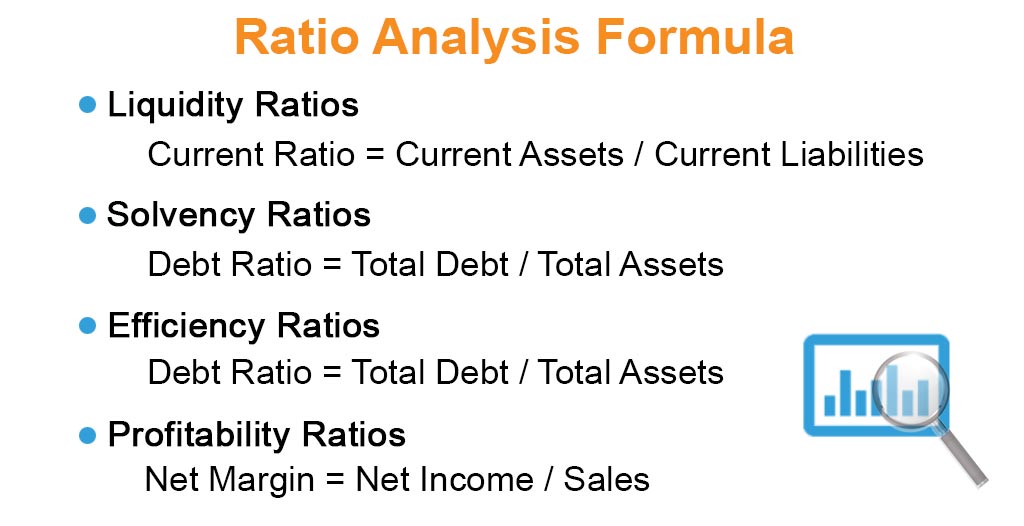

Current ratio Current assets Current liabilities Current ratio 2014 103000 93800 110 times Current ratio 2015 129750 104250 124 times b. Common liquidity ratios include the following.

Financial Ratio Analysis How To Interpret Ratios To Analyse A Company Getmoneyrich

Round your final answers to 2 decimal places a.

. Long-term debt ratio b. Total debt ratio c. INCOME STATEMENT Figures in millions Net sales 12800 cost of goods sold 3860 Other expenses 4127 Depreciation 2398 Earnings before interest and.

Cash ratio Cash Current liabilities Cash ratio 2014 9000 93800 10 times. Calculate the following ratios Long-term debt ratio long-term debt long-term debt equity 0266 Total debt ratio total liabilities total assets 0777 Times interest earned ratio interest cover ratio EBIT interest payments 3746 Cash coverage ratio EBIT depreciation interest payments 7422. Average collection period k.

Days in inventory j. Return on capital use average balance sheet figuresd. Days in inventory 268 2244 days4360 365 e.

Long-term debt ratio b. 26 Calculate the following financial ratios for Phone Corporation. The current ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities.

Return on equity 1222 1119 or 111911524 10321 2 b. Return on assets m. Round your final answers to 2 decimal places 1.

Return on assets m. Saved 4 Here are simplified financial statements for Phone Corporation in a recent year. Return on capital use average balance sheet figures 3.

Return on equity. Do not round intermediate calculations. Here are simplified financial statements for Phone Corporation in a recent year.

Return on assets 1222 7151 35 0602 or 60228200 27809 2 c. Times interest earned d. Here are simplified financial statements for Phone Corporation in a recent year.

Calculate the following financial ratios for Phone Corporation. Total debt ratio7224Total Liabilities 19574Total assets 27095 x 100. Calculating Financial Ratios for Phone Corporation.

Here are simplified financial statements of Phone Corporation from a recent year. Return on assets use average balance sheet figuresc. Return on equity use average balance sheet figures b.

View the full answer. Days in inventory j. Round your final answers to 2 decimal places.

INCOME STATEMENT Figures in millions of dollars Net sales 13800 Cost of goods sold 4410 Other expenses 4182 Depreciation 2728 Earnings before interest and taxes EBIT 2480 Interest expense 720 Income before tax 1760 Taxes at 35 616 Net income 1144 Dividends 926. Average collection period k. LCurrent ratio681 Total current assets 3570Total current liabilities 5240 x 100.

Return on assets use average balance sheet figures c. Use 365 days in a year. Net profit margin h.

INCOME STATEMENT Figures in millions Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes EBIT Interest expense. Times interest earned d. Return on equity use average balance sheet figuresb.

Calculate the following financial ratios. Average Stockholders Equity 8524 8321 2 Average Stockholders Equity 842. Return on equity 1.

Here are simplified financial statements for Phone Corporation in a recent year. Calculate the following financial ratios for Phone Corporation. JTimes interest earned36 times EBIT 2325Interest expense 645 kCash coverage ratio287 Cash and marketable securities 150Total current liabilities 5240 x 100.

Financial Ratios Calculators help determine the overall financial condition of businesses and organizations. Total debt ratio. INCOME STATEMENT Figures in millions Net sales 13600 Cost of goods sold 4310 Other expenses 4162 Depreciation 2668 Earnings before interest and taxes EBIT 2460 Interest expense 710 Income before tax 1750 Taxes at 30 525 Net income 1225 Dividends 906 BALANCE.

INCOME STATEMENTFigures in millions Net sales12900 Cost of goods sold 3910 Other expenses 4132 Depreciation 2428 Earnings before interest and taxes EBIT2430 Interest expense 670 Income before tax1760 Taxes at 35 616 Net income1144 Dividends846. Use 365 days in a year. Do not round intermediate calculations.

Do not round intermediate calculations. Return on capital 1222 7151 35 1018 or 1018 5524 11524 5759 10321 2 d. Cash coverage ratio e.

Operating profit margin h. Here are simplified financial statements of Phone Corporation from a recent year. Figures in millions This Year Last Year Assets Cash and marketable securities total current liabilities 80 x cash ratio 06 48 39 Accounts receivable total current liabilities 80 - Cash 48 32 53 Inventories total current assets 96 - cash 48 - accounts recievable 32 16 45 Total current assets total liabilities 80 x current ratio 12 96 137 Net.

Use 365 days in a year. INCOME STATEMENT 25 Figures in millions points Net sales 13300 Cost of goods sold 4 160 Other expenses 4 087 Depreciation 2 578 eBook Earnings before interest and taxes EBIT 2475 Interest expense 695 Print Income before tax 1 780 Taxes at 30 534 Net income 1 246. Return on Assets use average balance sheet figures 2.

Days in inventory use start of year balance sheet figures. Return on capital use average balance sheet figures d. Quick ratio Current assets - Inventory Current liabilities c.

Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations. View the full answer. Here are simplified financial statements for Phone Corporation in a recent year.

Average Stockholders Equity 8524 8321 2 Average Stockholders Equity 842. Cash coverage ratio e. The current ratio also known as the working.

Here are simplified financial statements for Phone Corporation in a recent yearCalculate the following financial ratios for Phone Corporation using the methodologies listed for each parta.

Financial Ratios Calculations Accountingcoach

Ratio Analysis Formula Calculator Example With Excel Template

No comments for "Calculate the Following Financial Ratios for Phone Corporation"

Post a Comment